How much salary is needed for first home or upgrade to Condo

Buying a home is one of the biggest financial decisions many people make in their lifetime. Whether you are a first-time homebuyer or upgrading from your current property, it can be an exciting yet daunting process. One of the most common questions people ask themselves is how much they need to buy their dream home. While it is important to consider your salary and down payment, there are other factors to consider before choosing your first or next property.

When it comes to purchasing a property, many people tend to focus solely on their salary and down payment. While these are important factors, it is essential to take a more holistic approach. There are several other concerns that need to be addressed before buying a property for your stay or investment.

The maximum loan amount you can apply for is determined by several factors. For a couple, it mainly depends on their gross income, combined income, average age to determine the loan period, loan to value, financial loan they currently have and buyer stamp duty. These factors play a significant role in determining how much you can borrow to buy your dream home.

Gross income is the total amount of money you earn before any taxes or deductions. The higher your gross income, the more you can borrow to purchase a property. Combined income refers to the total income of both you and your spouse or partner. If both of you have a steady income, it can increase the amount you can borrow.

The average age of the couple is also a crucial factor in determining the loan period. The younger the couple, the longer the loan period can be. This means that you can borrow more money to buy your dream home if you are young.

The financial loan you currently have also plays a significant role in determining how much you can borrow. If you have an existing loan, it can affect your borrowing capacity. Lenders will consider your debt-to-income ratio (Total debt servicing ratio – TDSR) to determine whether you can afford to repay the loan.

Finally, buyer stamp duty is a tax imposed by the government on the purchase of a property. The amount you need to pay depends on the purchase price of the property. It is essential to factor in this cost when considering how much you need to buy your dream home.

Private Condo

Let’s take a look at the scenarios below for purchasing a private condo.

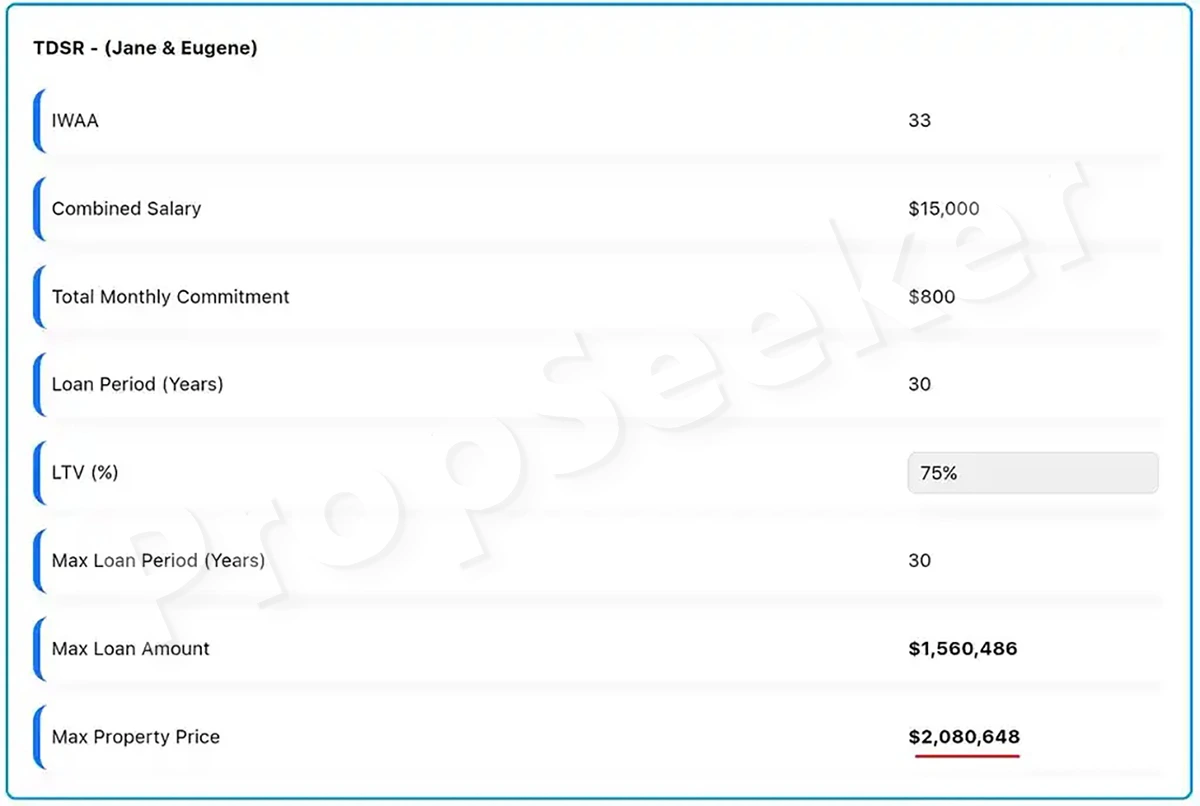

Scenario 1:

Jane, age 30, and Eugene, age 35, are both buying their first private condo. Jane earns $6,500 per month, while Eugene earns $8,500 per month with a motor car loan of $800 per month. After calculation, both Jane and Eugene are eligible to purchase a private condo at an approximate price of $2,080,648 with an approximate maximum loan amount of $1,560,486.

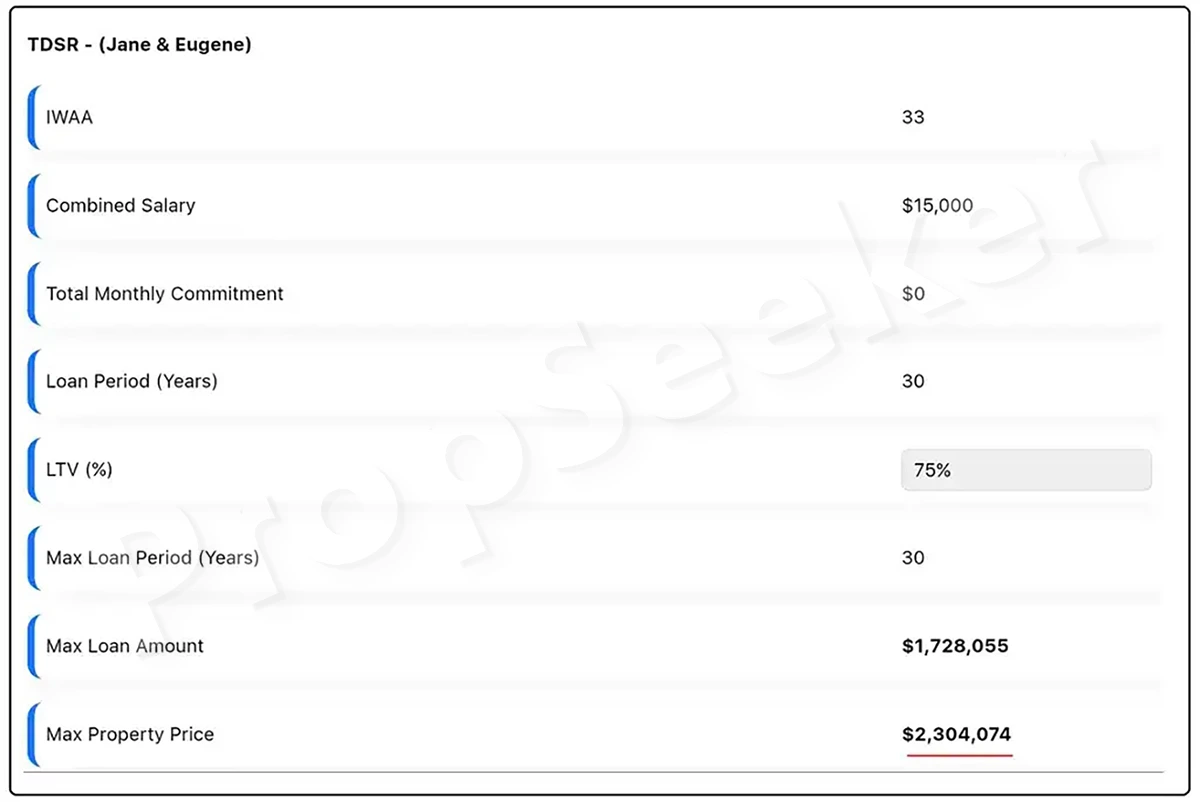

Scenario 2:

Jane, age 30, and Eugene, age 35, are both buying their first private condo. Jane earns $6,500 per month, while Eugene earns $8,500 per month with no existing financial loan. After calculation, both Jane and Eugene are eligible to purchase a private condo at an approximate price of $2,304,074 with an approximate maximum loan amount of $1,728,055.

In conclusion, taking the time to work out your finances before purchasing your first home or upgrading to a private condo is crucial to ensure a sound financial future. At PropSeeker, we understand the importance of proper financial planning and offer a free consultation to help you make informed decisions. Click the button below to get started on your journey towards financial stability and homeownership today.

Do follow our Facebook and Instagram to get more property insights!

Click below and get a free consultation and financial planning