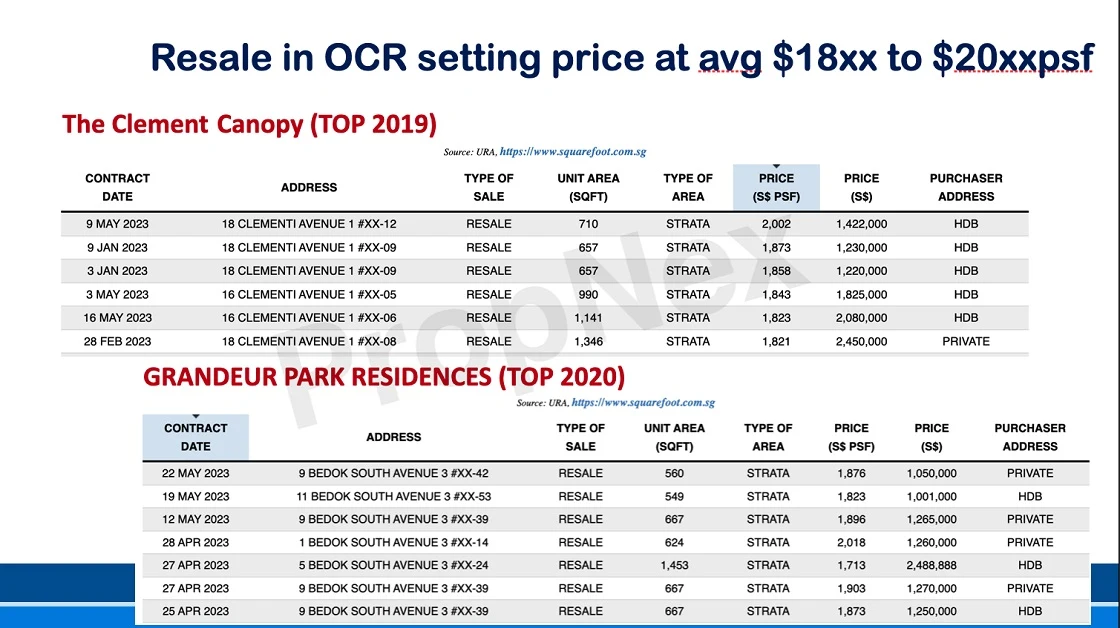

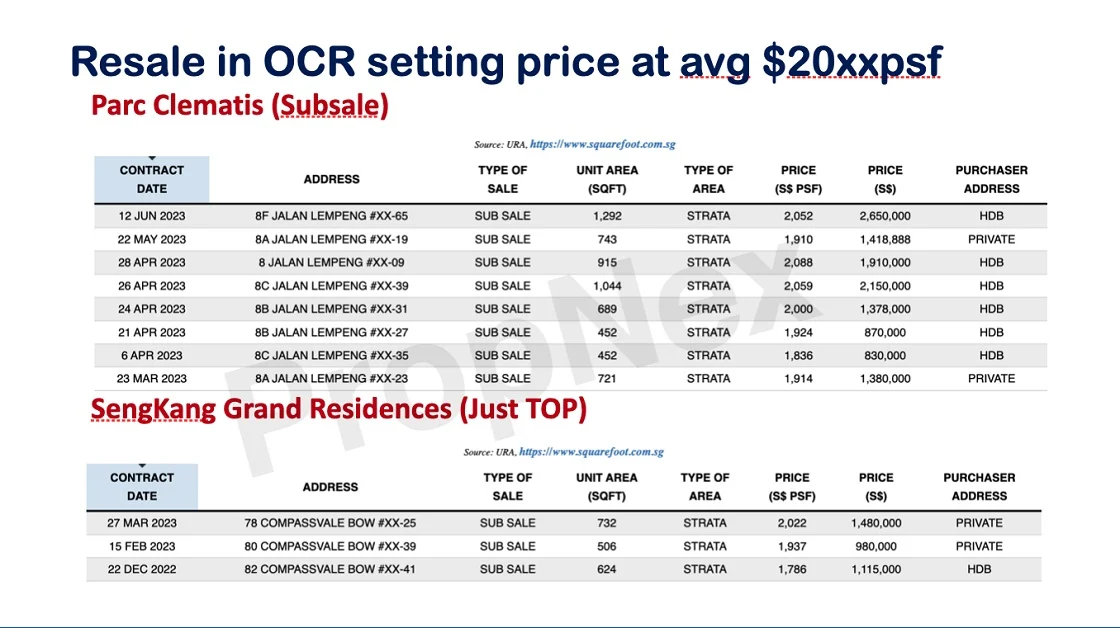

Let’s take a look at the examples of The Clementi Canopy and Grandeur Park Residences which TOP in 2019 and 2020 respectively, their prices also hover around the $1,800 – $2,000 range. Or the more recent launches such as Parc Clematis and SengKang Grand Residences which are respectively only at a sub-sale stage and just TOP, are also selling at an average of $2,000 psf.

It goes to show that the demand for properties in the OCR market has pushed prices to the $2,000 psf mark that it is today. What does that say about the new launches in OCR?

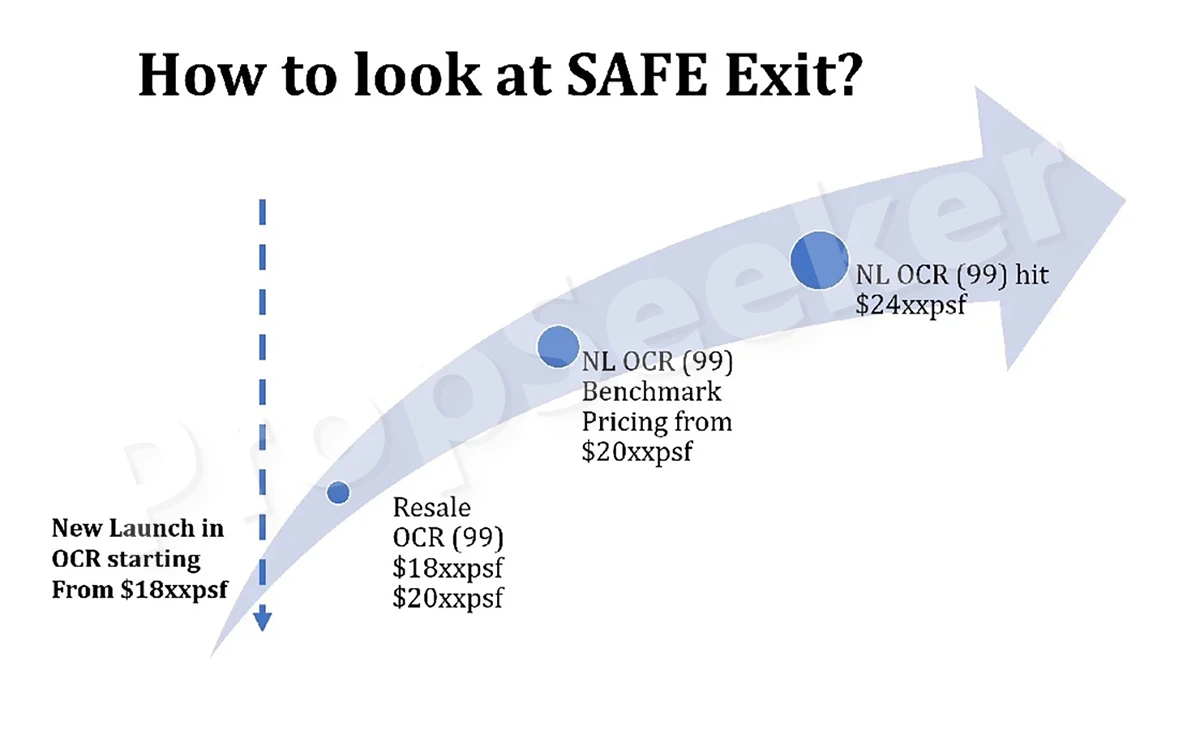

New launches in the OCR are launched at an average price of $1,800 psf, with the resale market hovering around the $1,800 – $2,000 psf range, and we have also seen OCR resale prices hitting as high as $2,400 psf.

That begs the question, why are OCR new launch selling relatively lower than the resale prices? This is due to the current market conditions that we are facing, with higher interest rates, cooling measures, and the supply of GLS introduced to the market. That is why developers are offering attractive prices for their new launches in the OCR.

So if you ask me if there are opportunities in the OCR market? The answer would be a resounding YES! Considering the price movements over the past 10 years, didn’t you wish you have bought one earlier? What do you think the prices are going to be in the next 5 years?